The Architect of

American Resilience.

Intelligent. Ethical. High-Yield.Deploying strategic capital into the essential assets that sustain civilization: Soil, Shelter, and Care.

Investment Thesis

Tangible Assets

We avoid speculation. We invest in the fundamental pillars of the American economy.

Our Philosophy

Beyond the

Quarter.

We do not chase market volatility. We invest in permanence. Our strategy creates intergenerational wealth by securing the tangible infrastructure—farmland, housing, and healthcare—that communities rely upon for survival and growth.

Trusted by Leading Organizations

We are proud to have collaborated with and earned the trust of these esteemed institutions.

Our Leadership

Architecting the future of GrowShare Capital through integrity, strategy, and innovation.

Founding Leadership

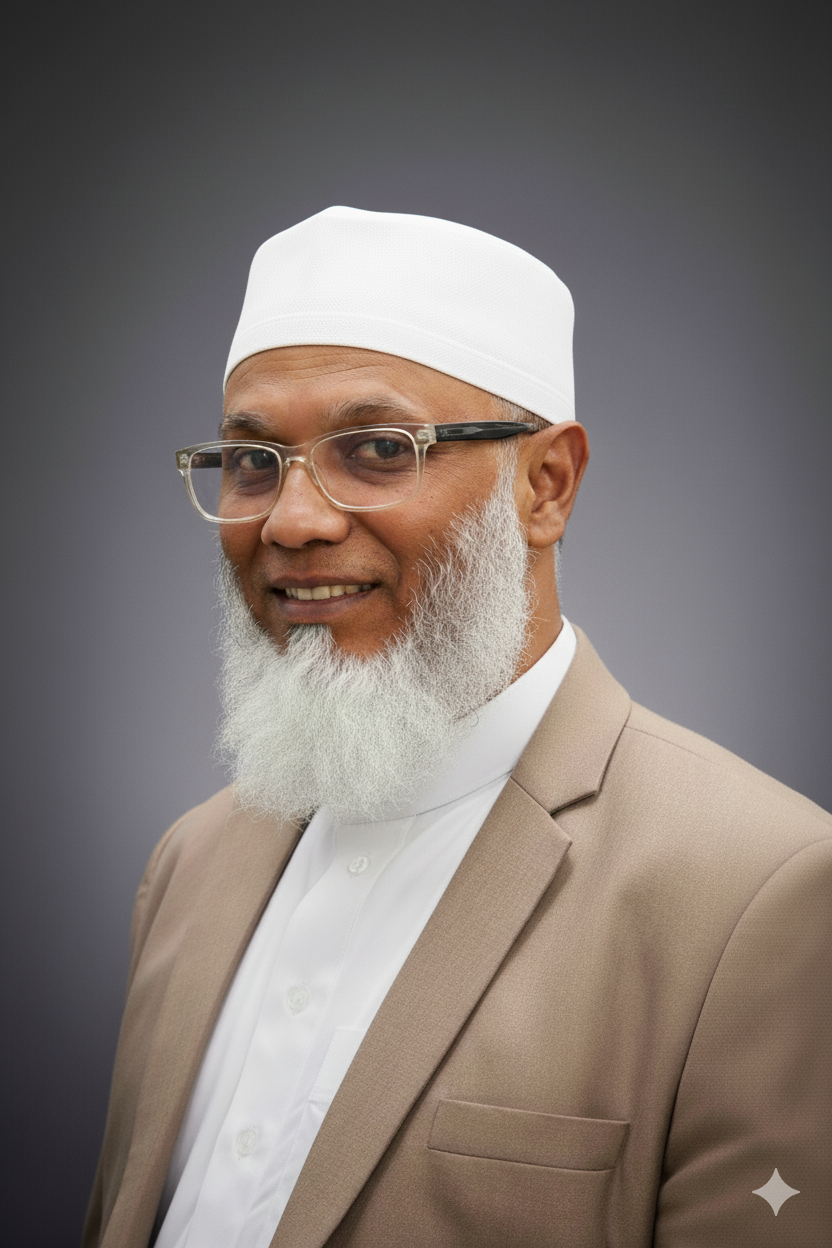

Dr. Aminuddin Khan, MBBS FCPS

Director & Chairman

Ashif Jahan, MBA

Director & Chief Executive Officer

Abid Abdullah, MSS

Director & Chief Operating Officer

MD Abul Mansur, MIS

Director & Chief Strategy Officer

Executive Directors

Kaukab Khan, MS

Director & Chief Technology Officer

Usman Nawid

Director & Chief Financial Officer

Ryan Kelley

Director & Operations & Development

Partners & Advisors

Babacar Thiaw

Chief Investment Officer

Kazi Nabiul Haque

Chief Marketing Officer

Build a Legacy.

Partner with us to deploy capital into high-yield, ethically compliant assets.

Inquire Now